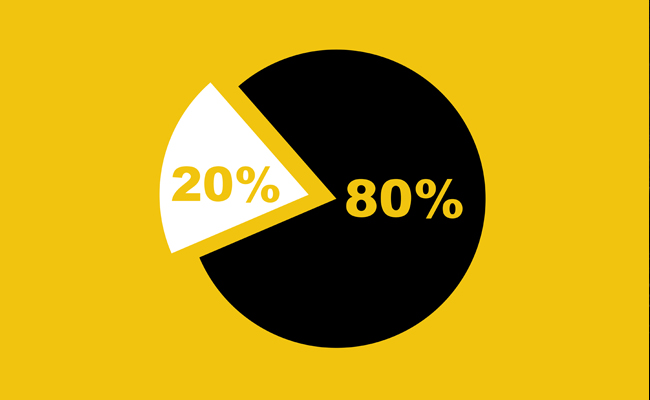

The 80/20 rule, also called the Pareto principle after economist Vilfredo Pareto, is a widely accepted concept among productivity experts. This principle states that 80% of your results stem from just 20% of your efforts. By applying this principle to your work or personal life, you can maximize your results while minimizing the amount of effort you expend. Keep reading to learn more about using the 80/20 rule to improve your finances.

What Is the 80/20 Rule?

The 80/20 principle suggests that 80% of outcomes come from just 20% of inputs. For example, most white-collar employees derive 80% of their productivity from 20% of their effort. This means the remaining 80% of their work time yields only 20% of the result.

Entrepreneurs and business owners can leverage the 80/20 rule to significant effect. For instance, I once applied this principle to my business and discovered that 80% of my time was spent on a low-profit service. I grew my income quickly by focusing on the 20% of work that generated 80% of my revenue.

You can also apply the 80/20 rule to your personal finances and investment strategy to grow your wealth over time. With this in mind, let’s explore a few potential applications of the 80/20 rule in your finances.

The 80/20 Rule in Budgeting

The 80/20 rule is a simple and accessible way to budget. It involves dividing your spending plan into two categories: one for spending and another for saving and investing. With just two classes to track, it’s easy for anyone to use – even without a budgeting app. For instance, if you earn $50,000 annually and use the 80/20 rule, you’ll save $10,000 annually and spend the remaining $40,000. Saving 20% of your income is a good goal, and experts recommend saving at least 15% for retirement. While a more detailed budget may be helpful, comparing your spending to the amount you save can help you stay close to the 80/20 guideline. Overall, this budgeting rule is grounded in solid advice. For those seeking financial management support, we recommend using Empower to manage your finances at no cost.

The 80/20 Rule and Investing

The 80/20 rule for investment suggests that 20% of your holdings will yield 80% of your returns. However, investing in only one-fifth of the stocks is not advisable, as maintaining a diverse portfolio is essential. While it is impossible to predict the future, a diverse portfolio that spreads out your risk is the best investment plan.

The 80/20 rule can still be used in other ways in investments. For instance, 80% of investment dollars are in retirement accounts, 20% in taxable portfolios, 80% in passive index funds, and 20% in single stocks. Alternatively, 80% of your taxable portfolio in blue-chip stocks and 20% in small to midcap stores can work. Lastly, 80% of your alternative investments in real estate and 20% in cryptocurrency can also be considered.

There is no limit to the number of ways the 80/20 rule can be used. With the right approach or financial advisor, one can beat the market and achieve above-average investment results.

Remember the 80/20 Rule in Your Finances and Beyond

My family and I have increased our income by applying the 80/20 rule to our business and finances. This principle can be used to optimize your budget, career, portfolio, and other areas of your life. However, it’s important to remember that you shouldn’t apply the 80/20 rule to your relationship with your spouse, as it could lead to negative consequences. When it comes to your finances, though, this rule can be a powerful tool. Look closely at your finances and identify areas to optimize and improve your long-term results.